Anytime you're in an auto mishap as well as there are problems to your auto that would be covered under comprehensive or crash protections, you'll be liable for paying the deductible under each of those protections. You can pick different deductibles within your auto insurance policy policy for both crash and also thorough. If you have multiple automobiles on your car insurance coverage, you can additionally select various deductibles for each and every auto.

vehicle cheap insurance auto insurance vehicle insurance

vehicle cheap insurance auto insurance vehicle insurance

You can choose various insurance coverage limits for all of them, as well as established deductibles, depending on which protection it is. Why can not you constantly select your insurance deductible?

Because they aren't responsible for as much cash, they have much less threat. So they charge a lower automobile insurance coverage costs. Simply put, a greater insurance deductible amounts to lower insurance costs. A reduced insurance deductible equals greater insurance premiums. An example would certainly be an insurance plan with a $500 accident insurance deductible.

This falls under collision insurance coverage. When choosing vehicle insurance policy protection, you picked the reduced insurance deductible of $500. The insurance company would currently have to pay out $9,500. What if you selected a high deductible of $2,500? After that the insurance company would only have to pay out $7,500. They have less threat, so you'll pay a lower costs.

What Is A Disappearing Deductible? - Mapfre Insurance Things To Know Before You Buy

This can be danger Suppose like in the example above, you chose a $2,500 insurance deductible but didn't have that money handy? When you file an insurance case, you'll be invoiced for your insurance deductible. If you do not have that $2,500 ready to pay you might be stuck in a bind with a fixing store.

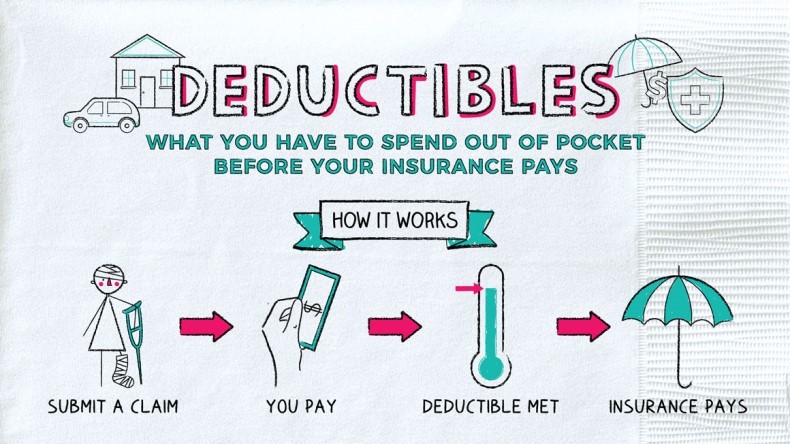

You may have wondered in the past, how do insurance policy deductibles function? What are the different types of deductibles, as well as does the quantity impact the monthly repayments? In easy terms, a deductible is the quantity of money you devote to pay of pocket before your insurance provider starts to pay you any advantages (cheap).

For instance: State you have a deductible of $500 as well as you back end someone. If you are the at-fault driver, the coverage will need to originate from your collision policy. If your problems are $2000, you will have to pay the $500 deductible and after that your insurance policy will pay the remaining $1500.

You would pay the complete $400 and also your insurance would certainly not pay anything, because you did not reach the insurance deductible - cheap insurance. Different types of deductibles: A deductible can be a fixed quantity or a portion of the complete expense of your claim.

The Best Guide To How Does A Car Insurance Deductible Work? - Quotewizard

So if you select a higher insurance deductible your premium cost will be reduced. Simply keep in mind, if you choose a high insurance deductible, you require to have at least that much cash conserved in instance you obtain right into an accident and have to pay it. Where to discover your insurance deductible: If you already have an insurance coverage, you can discover the quantity of your insurance deductible on the primary page of your plan, recognized as the. insure.

It is near the front of your plan. Examine to see what your insurance deductible is, and also if you have any problem discovering it or any kind of other questions whatsoever, call an Infinity agent at!.

An automobile insurance policy deductible is the quantity an insurance policy holder is accountable for paying when making an insurance claim with their cars and truck insurance firm after a covered incident. credit score. This needs to occur prior to insurance pays the costs of problems. If a cars and truck incurs $5,000 well worth of damage in a covered mishap and the motorist has a $1,000 deductible, they would certainly pay $1,000 of the repair service costs and the insurance provider would pay $4,000.

The motorist would merely pay their deductible. When you do not have to pay a car insurance policy deductible, There are specific situations when individuals do not need to pay a cars and truck insurance coverage deductible. If one more driver triggers a crash and also their insurance pays In a lot of states, a vehicle driver that is accountable for triggering an accident is obligated to spend for all damages linked with the accident (vehicle insurance).

Fascination About How Do Deductibles Work For Car Insurance? - Kelley Blue Book

If somebody's very own lorry is additionally harmed in the exact same event and also they want to make an insurance claim for fixings under their accident coverage, their deductible will use. If the certain type of damages does not need paying an insurance deductible In many cases, certain losses are covered without a deductible.

If someone went with no insurance deductible when getting insurance coverage Insurance companies might allow people to go with insurance coverage with a $0 insurance deductible. If someone has no deductible, they won't owe anything expense when a covered occurrence takes place. Remember, though, the cost of auto insurance will be greater if someone chose a no-deductible policy.

money auto credit score money

money auto credit score money

What's the average car insurance deductible? The average car insurance deductible is $500. Just how much of an insurance deductible should I select for my auto insurance policy?

cheaper cars affordable auto insurance cars car insurance

cheaper cars affordable auto insurance cars car insurance

Here are some essential considerations. Risk tolerance, When selecting a plan with a higher insurance deductible, people take a larger threat. They're gambling that they won't need to make a claim and pay out-of-pocket expenses. Those who aren't comfortable taking that opportunity might intend to pay higher costs to pass even more of the risk of economic loss on to their insurance coverage service provider.

All About Which Car Insurance Deductible Is Right For You? - The Zebra

Those that often tend to have little cash conserved for unanticipated costs may intend to select a reduced insurance deductible. suvs. People with a substantial reserve can most likely pay for to take a chance of incurring higher out-of-pocket expenses if they make an insurance coverage claim. The likelihood of an insurance claim, The most likely it is somebody will certainly make a claim, the reduced they must establish their deductible.

If the chances of a protected event are not likely, a vehicle driver may be better off maintaining their costs low. Some people can conserve around $220 each year on comprehensive as well as crash protection by changing from a policy with a $50 insurance deductible to one with a $250 deductible - insured car. By placing the costs savings into a checking account, an individual could have adequate cash in around a year to cover the included deductible amount.

As long as a vehicle driver doesn't enter a crash in much less than a year, they 'd be much better off. The value of the car, If a car isn't worth a lot, it might not pay to have insurance coverage with a high insurance deductible. State a motorist opts for crash coverage with a $1,000 insurance deductible and their vehicle is just worth $1,000 (car).

In this instance, the motorist would be far better off forgoing accident insurance coverage completely. Just how to stay clear of paying a cars and truck insurance policy deductible, The very best means to avoid paying a cars and truck insurance policy deductible is to stay clear of mishaps, theft, or damages. Method defensive driving, comply with the guidelines of the road, comply with the speed limitation, as well as avoid driving in negative weather.

Some Known Facts About Auto Insurance Deductible - Rogersgray.

Individuals can likewise pick a policy with no deductible, albeit at a higher price. Or they can enroll in a vanishing or going away deductible with insurance providers that supply it - insurance company. This will minimize the amount of the deductible by a set amount throughout each period the motorist is devoid of crashes.

A deductible is what you pay out of pocket to fix your car prior to your auto insurance policy pays for the rest (low cost). If you lug thorough as well as collision insurance coverage on your cars and truck insurance coverage, you will see an insurance deductible detailed on your plan as a dollar quantity.

When do you pay your insurance deductible? You only pay the deductible for repairs made to your very own vehicle. Nevertheless, you don't pay an insurance deductible for other cars associated with the accident, even if you are found responsible. However, there are some exceptions to paying an insurance deductible for damages to your automobile (low cost auto).

Just how much will you conserve every year on premiums? Would certainly these cost savings make a purposeful effect on your budget plan? This is where the worth of your cars and truck can be a large element. More recent vehicles are more pricey to replace than older cars. For that factor alone, you may see a big cost jump in your premium if you opt for the lower deductible.

The Main Principles Of Understanding Your Insurance Deductibles - Iii

But if you're still favoring a greater insurance deductible, believe regarding this: Click here Exactly how long would it take to redeem what you'll invest in premium costs? If it's simply going to take you a year or 2, the greater insurance deductible might still be looking great - laws. Otherwise, the lower insurance deductible may make even more feeling.

Consider exactly how you utilize your automobile. Where do you live? Where do you drive to? Where do you park? If you reside in a peaceful area with a brief commute to work, you might fit with a greater insurance deductible. Ultimately, it's your call. Make certain and also talk with your ERIE representative to assist you figure out which strategy is best for you.

If you're in the marketplace for a brand-new cars and truck insurance plan, it's essential to locate the appropriate insurance coverage and insurance deductible for you. Eventually, how much defense you have as well as what you pay out-of-pocket are based upon the kind of protection you obtain and the car insurance policy deductible you pick. It can be tempting to pick the highest possible deductible as that usually causes a reduced regular monthly premium.

Figure out what to consider when choosing a car insurance policy deductible for your demands, budget plan, and also lifestyle. What is a car insurance deductible? An auto insurance coverage deductible refers to the total quantity an insurance holder pays out-of-pocket before the insurance covers a professional occurrence. As an example, if you enter into a fender bender that results in $2,000 of repair services and you have a $500 car insurance policy deductible, you get on the hook for $500, and your vehicle insurer will cover the remaining $1,500.

The Facts About Deductible In Car Insurance Policy - Icici Lombard Revealed

prices insured car auto insurance risks

prices insured car auto insurance risks

What makes auto insurance coverage various from other types of insurance coverage is that you are in charge of paying the deductible each time you sue. Exactly how does a vehicle insurance coverage deductible job? If you enter into a cars and truck mishap or other type of incident covered under your policy, you'll need to submit an insurance claim (trucks).

You may likewise pay the deductible directly to the service center fixing your automobile - dui. Your auto insurance deductible is your obligation as well as has to be paid before your insurance provider covers the rest. What are deductibles based off of? As a customer, you can typically select a higher insurance deductible and also rack up a reduced car insurance coverage premium.

However if any type of damages or repair services are much less than the cost of your deductible, then it's unworthy suing. On the other hand, if you pick a lower auto insurance coverage deductible in between $100 and also $500, the chance of you suing rises. That suggests you'll likely pay a greater monthly costs and also be considered more of a danger to your insurance service provider (cheaper cars).

When do you pay the insurance deductible for car insurance policy? You don't have to pay your vehicle insurance deductible when picking a vehicle insurance coverage. Rather, you pay your car insurance policy costs. You have to pay your cars and truck insurance policy deductible when you make a case. The car insurance policy deductible can be payable to either your service center or your insurance coverage provider, relying on the amount, your plan, and also your provider's basic insurance deductible plan.